We’ve seen emissions rebound after dropping during the COVID-19 pandemic in 2020. Transport has the highest reliance on fossil fuels, accounting for 37% of CO2 emissions from end-use sectors in 2021, while building operations accounted for 27% of total energy sector emissions (8% direct emissions and 19% indirect emissions from electricity production and heat use). While electrifying transportation through electric vehicle (EV) adoption has attracted much attention and development over the last decade, we have not seen the same focus or progress in buildings.

One reason may be that the building market is much more complicated than the auto industry. Vehicles are produced in assembly lines and sold at a mass scale through well-known manufacturers. Advancing EV technology takes investment and time, but is achievable within the same market structure.

However, buildings are inefficiently produced with a more complex and crowded value chain. Each is designed with a distinct purpose that is eventually lost as tenants, managers, and owners change over. Systems are frequently retrofitted without long-term consideration or maintenance planning. While Americans spend 90% of their time indoors, buildings are so complicated that most of us lack even a basic understanding of our home or office boiler rooms. Yet, we expect buildings to outlive cars, sometimes by generations.

With the push for EVs going, it’s time to focus on reducing 27% of the world’s emissions and realizing trillions of dollars of operational savings potential. Now, with changing market structure and an explosion of building data, the time to tackle building efficiency has come.

Changing Market Structure

Unlike the dominance of auto manufacturers, a messy value chain has kept building equipment suppliers from achieving the same market chokehold. There has been a massive divide between energy and real estate. Customers sat at the bottom of the food chain as products dictated options and controls, and large providers often ignored medium and small buildings.

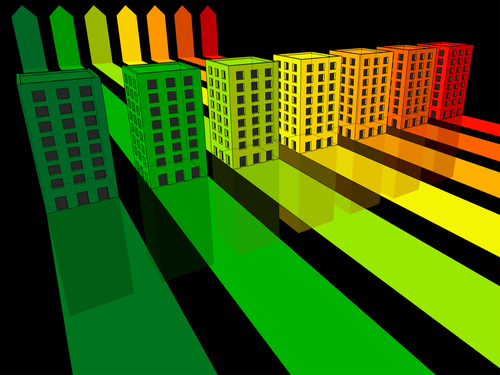

Traditional Building Market Structure

Fed-up customers and service providers have shown a strong willingness to find workarounds that threaten the business models of legacy companies by positioning them at the top of the food chain.

Scalable technology will enable similar service levels across all building types and sizes, allowing customers to enjoy equal options and treatment. Outsourcing integrated contracts to manage controls implementation, monitoring, and predictive maintenance will increasingly save customers time and money and close the divide between energy and real estate.

Also, with focus on reducing indirect emissions, HVAC will become its own asset class, and customers will most likely buy their energy management and HVAC financing through a turnkey services contractor.

Open architecture controls, along with analytics and reporting, will be the backbone of improving energy efficiency as data easily flows in, out and across building systems. This will allow dynamic building control and responsiveness to operating conditions while maintaining function.

Future Building Market Structure

Where We’re Going

Today, we’re somewhere in the middle of this transition to a new, clean, efficient building market structure. Additional market predictions include:

- Providers with closed systems attempting to protect their own data will become obsolete.

- The incentive misalignment between capital markets, real estate owner and operator, service provider, tenant, and regulator is fading. With accurate and available data on the true costs of efficiency and impacts on energy use, everyone’s goals to reduce energy use and cost are generally aligned to allow united forward movement.

- There has been a disconnect between building efficiency controls and energy solutions, which have largely failed to integrate and, therefore, scale. These market sectors must align in the future.

- Many real estate owners lack focus and understanding of their boiler rooms. Outsourcing ownership can provide credit and cost stability, along with operating reliability. As such, HVAC will benefit from becoming a standalone infrastructure asset class.

Improving building efficiency through market changes will require leadership, courage, and technology to fix decades of dysfunction, but companies are already taking action. It also will require leading building operational and energy efficiency investors to continue to dedicate funds to advancements in turnkey solutions that scale, which should then lower the friction costs of retrofits. By empowering the right leaders to apply financial pressure, we can see both benefits to customers and progress toward climate change goals.

Ben Birnbaum is a partner at Keyframe Capital, a firm that invests in companies at the cusp of the world’s energy transformation.

Editor’s note: The views expressed in this article are the author’s and do not necessarily reflect those of Facilities Management Advisor.